Loan Management Software

Advanced Loan Management Software for Smarter, Faster & Secure Lending

Financial establishments these days are swiftly shifting toward virtual lending, and the need for a robust automation machine has never been greater. Intelligrow is a powerful and scalable loan management software program designed to simplify, automate, and streamline the entire lending lifecycle. With shrewd workflows, speedy processing, and complete visibility, it enables banks, NBFCs, MFIs, and FinTechs to manage loans with efficiency or compliance.

Transforming Lending with Smart Automation

Conventional lending relies on Loan Software methods that slow down approvals and boost operational expenses. Intelligrow gets rid of those challenges by means of providing an stop-to-stop loan management software program that digitizes borrower onboarding, underwriting, disbursal, EMI control, and collections multi function centralized machine.

This automation guarantees quicker turnaround instances, reduced office work, and progressed borrower enjoy at the same time as preserving transparency and regulatory compliance.

Complete Loan Lifecycle Management

Intelligrow isn’t always just a basic Loan Software. It’s miles an organisation-grade device geared up with superior modules to guide each lending requirement. The platform adapts to enterprise Loans, private Loans, SME Lending, Microfinance, Gold Loans, purchaser long-lasting Financing, and more.

- Middle useful Modules

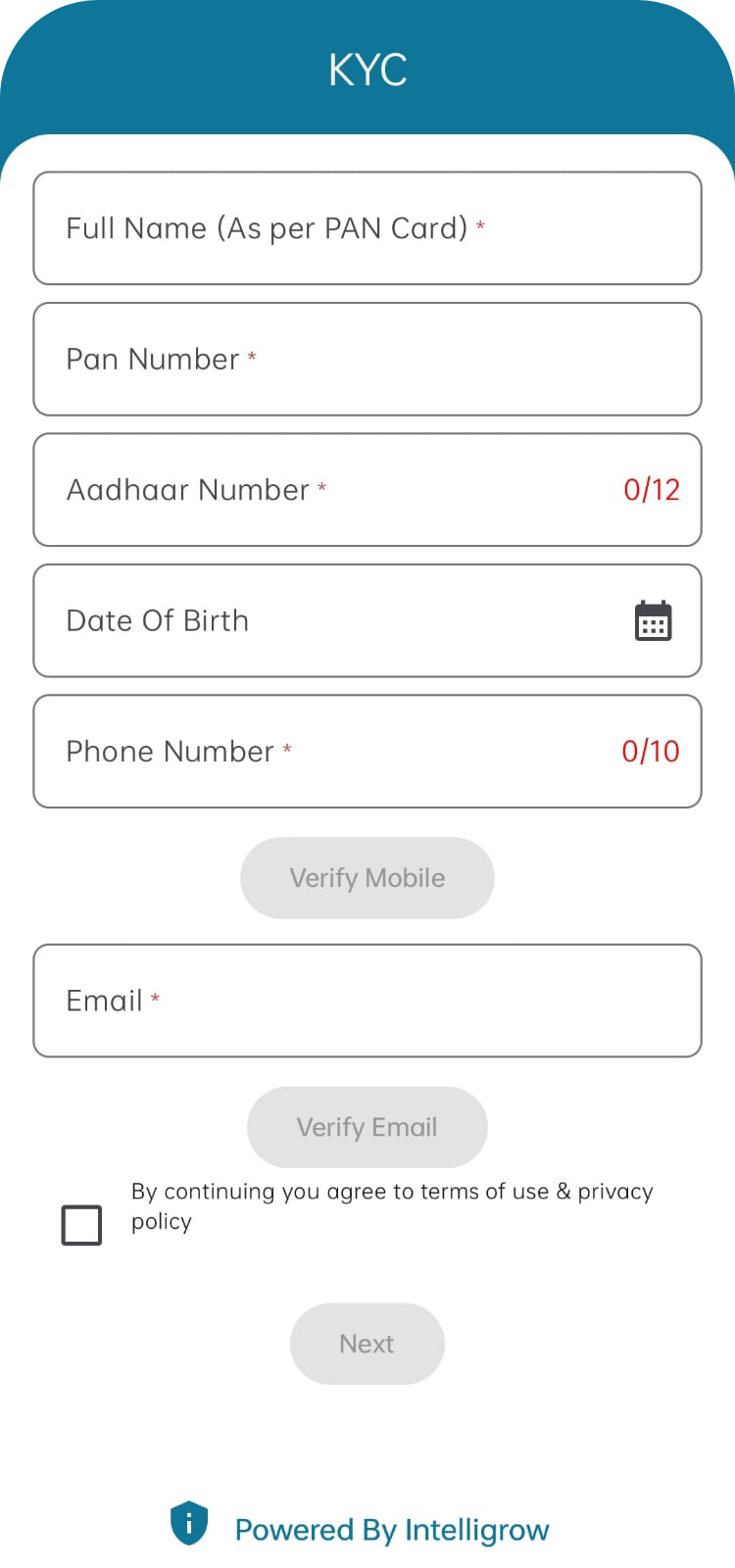

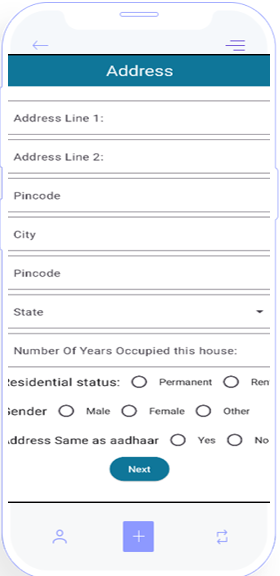

- virtual onboarding & seamless e-KYC

- Automated underwriting & rule-based credit score scoring

- Configurable loan products & hobby setups

- AI-enabled hazard assessment

- Disbursal & repayment automation

- series tracking & reminders

- Actual-time dashboards & MIS reporting

- Audit trails & compliance tracking

With these comprehensive features, Intelligrow serves as a shrewd loan management software program constructed for high-overall performance lending.

Automation That Speeds Up Lending

The power of Intelligrow lies in its advanced loan Automation software program capabilities. Through replacing manual responsibilities with automated workflows, the platform complements operational performance and accelerates loan approvals.

Automation benefits:

- Faster processing with predefined workflows

- Reduced human errors and advanced accuracy

- virtual verification through API integrations

- vehicle-generated EMI schedules

- collection reminders & follow-up automation

- actual-time analytics for records-driven choices

These automation tools allow creditors to scale operations effects while enhancing portfolio high-quality.

Seamless System Integrations

Cutting-edge lending requires robust connectivity with external structures. Intelligrow helps API-based integrations with savings bureaus, KYC systems, payment gateways, CBS answers, NACH systems, and accounting gear.

This ensures smooth facts flow, advanced verification, and a linked lending environment, all fundamental for green virtual lending.

Why Lenders Choose Intelligrow?

Intelligrow stands proud as a reliable Loan Management Software as it combines flexibility, security, and innovation in a single platform. Key advantages:

- Cloud-based or on-premise deployment

- Multi-department and multi-consumer architecture

- Customizable workflows for diverse loan types

- cell apps for area team of workers and borrowers

- invulnerable records encryption & function-primarily based access

- continuous technical help and committed onboarding

Whether you’re an emerging NBFC or a large financial institution, Intelligrow adapts to your needs and scales effortlessly as your portfolio grows.

Scalable, Future-Ready Lending Technology

Intelligrow grows with your employer. Whether you’re expanding into new markets, adding extra borrowers, or increasing loan merchandise, the platform scales effortlessly. The machine guarantees compliance with regulatory recommendations whilst keeping constant overall performance and stability. As virtual lending accelerates, establishments that undertake efficient loan software programs advantage a significant advantage in operational speed and consumer satisfaction.

A Future-Ready Platform for Digital Lending

Intelligrow is designed to meet modern-day lending needs while making ready establishments for the destiny. With its robust structure, advanced automation, and seamless integrations, it ensures faster loan cycles, better compliance, and advanced borrower pleasure.

Reach Us

QUICK INFO

Email: info@intelligrow.co

Address: Deshpande Startups Gokul Rd, Next to Airport, Hubballi 580030, Karnataka, India