Loan DSA Software

Advanced Loan DSA Software to Streamline Your Lending Business

In today’s aggressive lending environment, Direct Selling Agents (DSAs) need smarter digital tools to manage leads, process packages, and coordinate with multiple financial institutions more quickly and accurately. Intelligrow introduces an effective loan DSA software designed to automate your lending workflow, increase productivity, and improve conversions with real-time monitoring and smart integrations.

Whether you run a small DSA corporation or a large lending community, Intelligrow enables you to manipulate the entire process from lead sourcing to final disbursement on a single, tightly closed platform. If you’re looking to make stronger your operations and scale with self-belief, our loan DSA software is your ideal solution.

Transforming DSA Operations with Intelligent Automation

Manual DSA approaches regularly cause delays, errors, miscommunication, and neglected deals. Intelligrow solves those challenges through a totally digitised loan DSA software that simplifies multi-financial institution coordination, documentation, lead validation, and actual-time fame monitoring. Our platform is designed to help DSAs supply faster responses to customers whilst keeping accuracy, transparency, and whole technique manage.

End-to-End Loan Processing for All Lending Products

Intelligrow additionally features as a robust loan processing software with features that help more than one loan class, along with:

- Non-public Loans

- Commercial Enterprise Loans

- Home Loans

- Car Loans

- LAP & mortgage Loans

- MSME Loans

- Credit score cards

- Microfinance & more

The device guarantees each loan application is processed smoothly with automatic workflows that manual the DSA crew from lead acquisition to record series and final approval.

Key Features of Intelligrow Loan DSA Software

1. Lead control & smart Allocation: Easy leads from websites, social media, referrals, and offline resources in one dashboard. Assign them mechanically to sellers based on policies or priority.

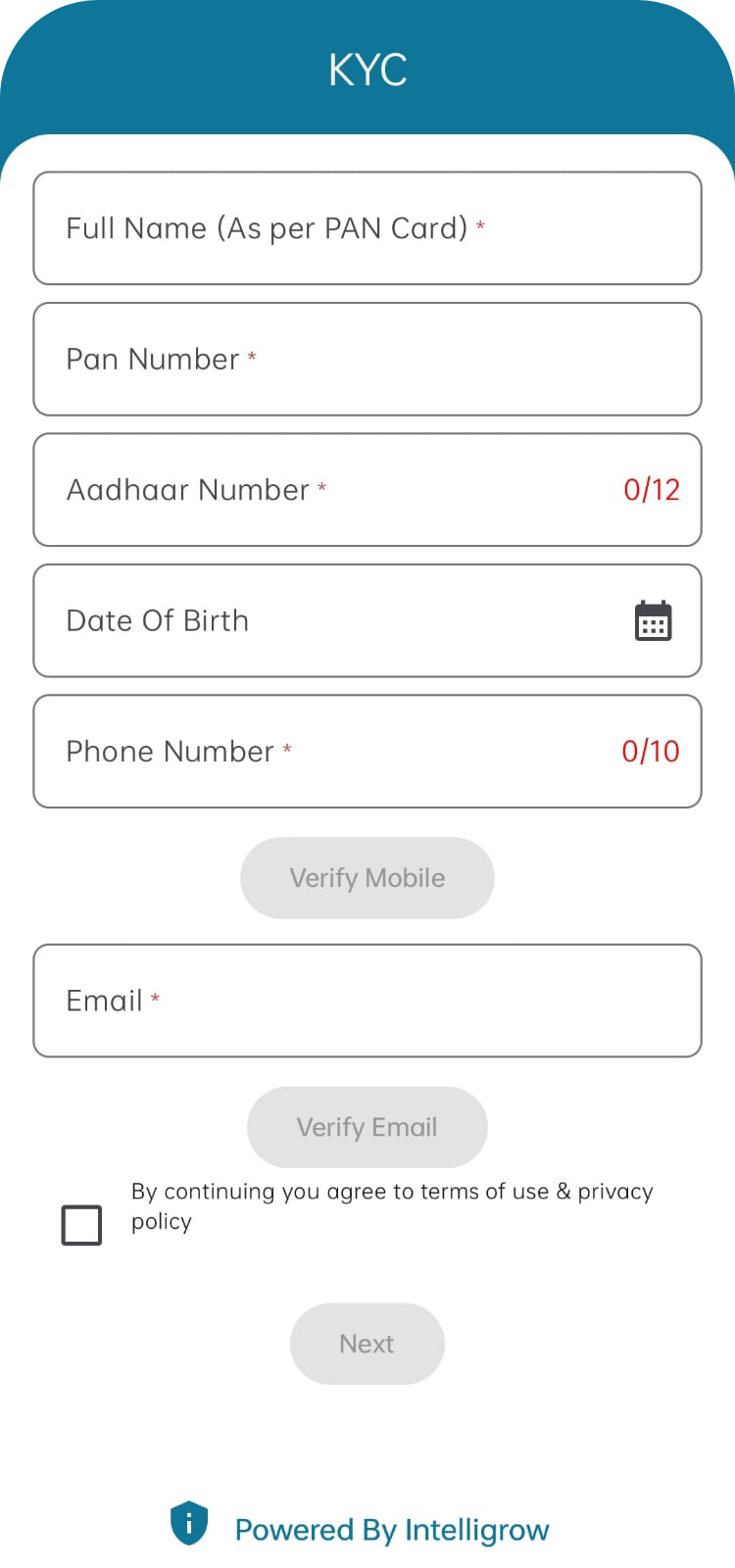

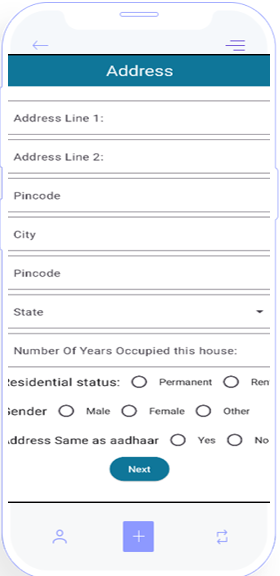

2. Digital KYC & file add: Gather KYC, earnings proofs, financial institution statements, and monetary files digitally, ensuring rapid and secure processing.

3. Automatic Eligibility check: Our loan DSA software program evaluates customer eligibility instantly the using of AI-powered scoring and lender-specific criteria.

4. Centralised communication: Cut out confusion with in-app chat, notifications, email updates, and lender coordination entirely in a single region.

5. Real-time utility tracking: Realise the exact status of every application, submitted, in overview, pending, authorised, or rejected.

6. Multi-Lender Integration: connect with multiple banks and NBFCs, put up programs, and tune each document separately.

7. MIS reviews & performance Analytics: Screen agent overall performance, lead satisfactory, approval ratios, commissions, and revenue increase.

With these skills, Intelligrow turns into the most dependable software for enhancing performance and last extra deals.

Why Choose Intelligrow for Your DSA Business?

Intelligrow stands proud due to the fact that it is constructed particularly for DSAs and lending companies that need automation, speed, and transparency. You get:

- Cloud-based, totally impervious, and cell-friendly platform

- Completely configurable workflows

- Computerized observe-ups & reminders

- Commission and payout tracking

- Secure virtual storage of patron records

- Multi-person access with function-based totally permissions

- API geared up for banking and 0.33-birthday party integrations

Our platform ensures your team remains efficient, prepared, and compliant for the duration of the complete loan cycle.

Accelerate Your Business with Powerful Loan Processing Software

As a complete Loan Processing software, Intelligrow removes pointless office work and guides responsibilities with the aid of automating client verification, Loan calculations, documentation, and submission procedures.

This reduces TAT (Turnaround Time), will increase approvals, and allows your DSA commercial enterprise to develop quickly with minimal effort.

Book a Free Demo & Grow Your DSA Business

If you’re ready to upgrade to smart virtual operations, now’s the time to transform your lending workflow with Intelligrow’s advanced loan DSA software program.

Ready to Scale Your DSA enterprise?

✔ Streamline operations

✔ Automate loan processing

✔ enhance consumer delight

✔ boom approvals & sales

Reach Us

QUICK INFO

Email: info@intelligrow.co

Address: Deshpande Startups Gokul Rd, Next to Airport, Hubballi 580030, Karnataka, India