Loan Automation Software

Advanced Loan Automation Software for Smarter, Faster & Secure Lending

Within the generation of digital finance, lending institutions can now longer rely upon manual tactics and outdated tools. To scale correctly, reduce threat, and supply better client experiences, economic enterprises want sensible automation. Intelligrow brings you a powerful, end-to-end loan Automation software program designed to streamline loan operations, minimise mistakes, and accelerate approvals, all while ensuring complete compliance and safety.

Whether you’re a financial institution, NBFC, MFI, or FinTech lender, Intelligrow equips you with the tools needed to automate, manage, and develop your lending enterprise with self-belief.

Looking to digitize your loan operations? Contact us today to get a free demo!

Transform Your Lending Workflow with Intelligent Automation

Intelligrow’s Loan Automation software gets rid of bottlenecks via changing slow, paper-heavy processes with speedy, rule-primarily based workflows. From borrower onboarding to EMI collections, each step is automatic to enhance pace, accuracy, and transparency.

What you can count on:

- Faster loan processing & approvals

- Automated documentation, verification & scoring

- Seamless virtual onboarding

- Real-time tracking of every mortgage

- Improved patron experience

- Reduced operational charges

With Intelligrow, lenders can scale swiftly without increasing manpower or risking compliance troubles.

Book Now to talk with our lending automation professionals.

End-to-End Loan Automation for All Lending Models

Intelligrow supports multiple lending products, making it best suited for diverse monetary institutions.

Our loan Automation software is built to address:

- Enterprise Loans

- Private Loans

- SME/MSME Loans

- Gold Loans

- client Finance

- Microfinance

- car Loans

- Housing Loans

The platform’s flexibility we could creditors to configure interest systems, EMI schedules, loan tenures, and threat regulations as in line with their enterprise model.

DSA-Friendly Platform: Powerful Loan DSA Software Integration

Intelligrow is likewise ready with a committed Loan DSA software module that simplifies channel partner management.

This module enables creditors and DSAs to work collectively smoothly with complete visibility and real-time updates.

Features for DSAs:

- Smooth borrower lead submission

- Live lead status tracking

- Automatic fee calculations

- Associate dashboard & performance reviews

- Secure report add

By way of combining Loan Automation software with DSA control tools, Intelligrow ensures that each accomplice stays informed and every lead is tracked effectively.

Key Features of Intelligrow’s Loan Automation Platform

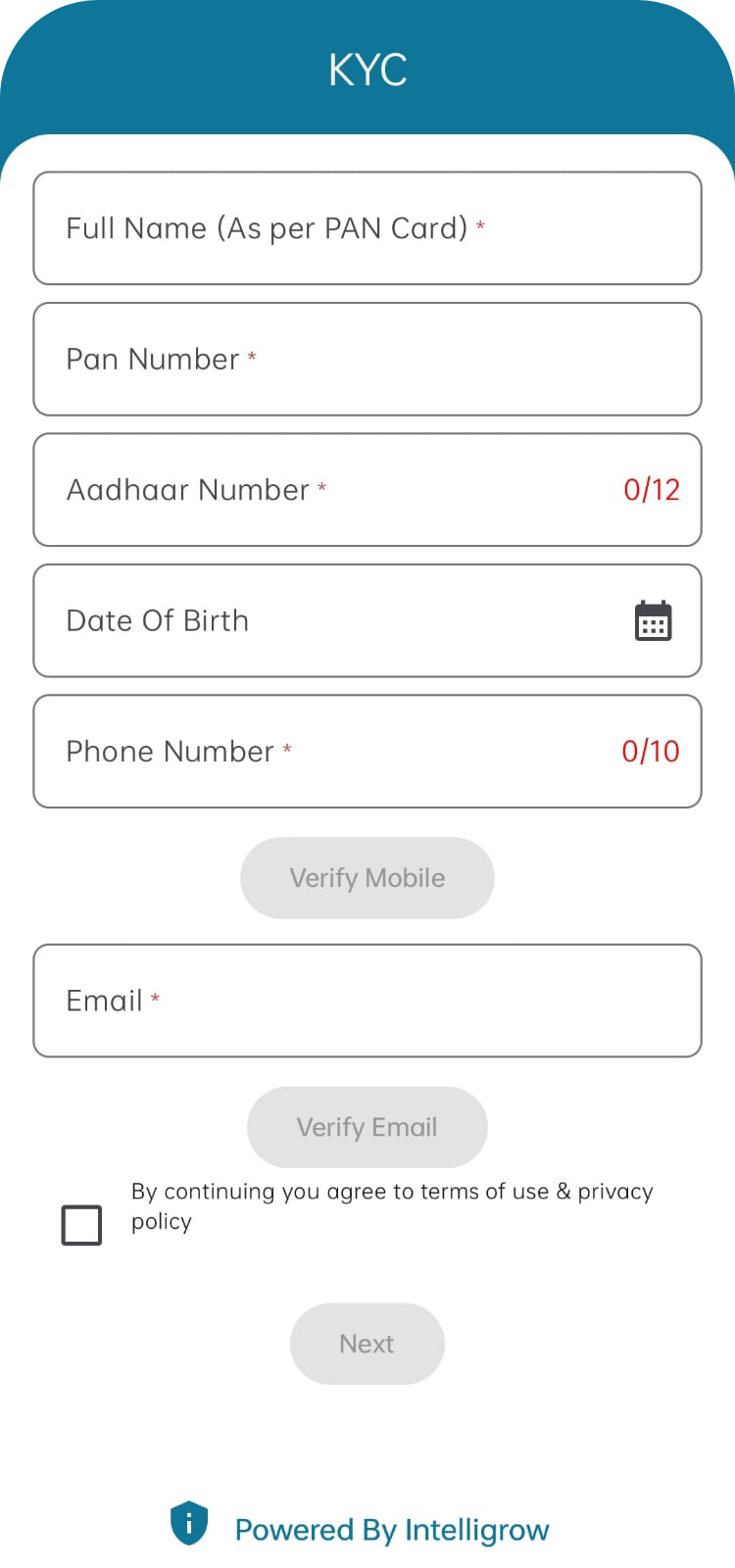

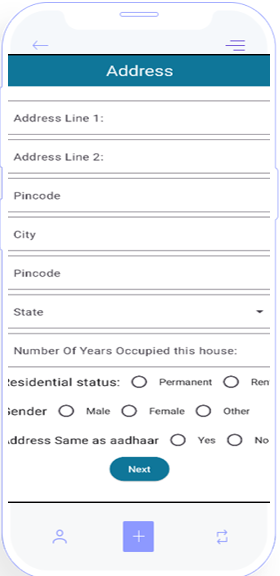

1. Digital Onboarding & e-KYC: Enable customers to use and get confirmed from somewhere through paperless onboarding.

2. Automated Underwriting: The machine analyzes earnings, credit score facts, KYC, and threat parameters to speed up choice-making.

3. Clever Disbursal & reimbursement monitoring: Automate NACH, status instructions, repayment schedules, reminders, and follow-ups.

4. Real-Time reports & Dashboards: Get right of entry to portfolio insights, delinquency developments, department-specific performance, and compliance reviews right away.

5. Tightly closed, Cloud-ready & Scalable: Intelligrow offers agency-degree protection and scalable architecture for lenders of every length.

Why Financial Institutions Choose Intelligrow?

- One hundred% configurable workflows

- API-ready platform for integrations

- Multi-department, multi-person guide

- Discipline agent & borrower cell apps

- Automated audit trails & compliance manipulation

- Dedicated customer support

Intelligrow simplifies lending operations and facilitates establishments’ cognizance of growth instead of operational challenges.

Get Started with Intelligrow Today

If your financial group is prepared to upgrade to trendy lending, Intelligrow’s superior loan Automation software is the right preference. Experience quicker loan processing, decreased threat, seamless companion control, and complete automation on a multi-functional, effective platform.

Reach Us

QUICK INFO

Email: info@intelligrow.co

Address: Deshpande Startups Gokul Rd, Next to Airport, Hubballi 580030, Karnataka, India