LOAN ORIGINATION SOFTWARE

Contact us

CONTACT US

What Are the Pivotal Advantages of Implementing Loan Origination Software in Modern Financial Institutions?

Due to the dynamic modern financial environment, loan origination software has proven to be one of the most essential foundations for responsible lenders looking to optimize their operational and compliance agility, even to the most extreme point, in smoothness. The software does not just continue with the lending protocols but rather provides an all-digital, end-to-end infrastructure from application intake to signing off on disbursement.

What is loan origination software?

Loan origination software is a digital platform that automates and consolidates the loan process, including borrower management, credit and debt procedures, document processing, underwriting, approval workflows, and regulatory compliance checks. Intelligent automation, leveraging data analytics and streamlined communication, can expedite loan approvals and reduce human error.

Loan origination software streamlines and automates the lending process.

Advanced loan origination software is complex, not just at a large scale but also through its modular design or intelligent potential features, including but not limited to:

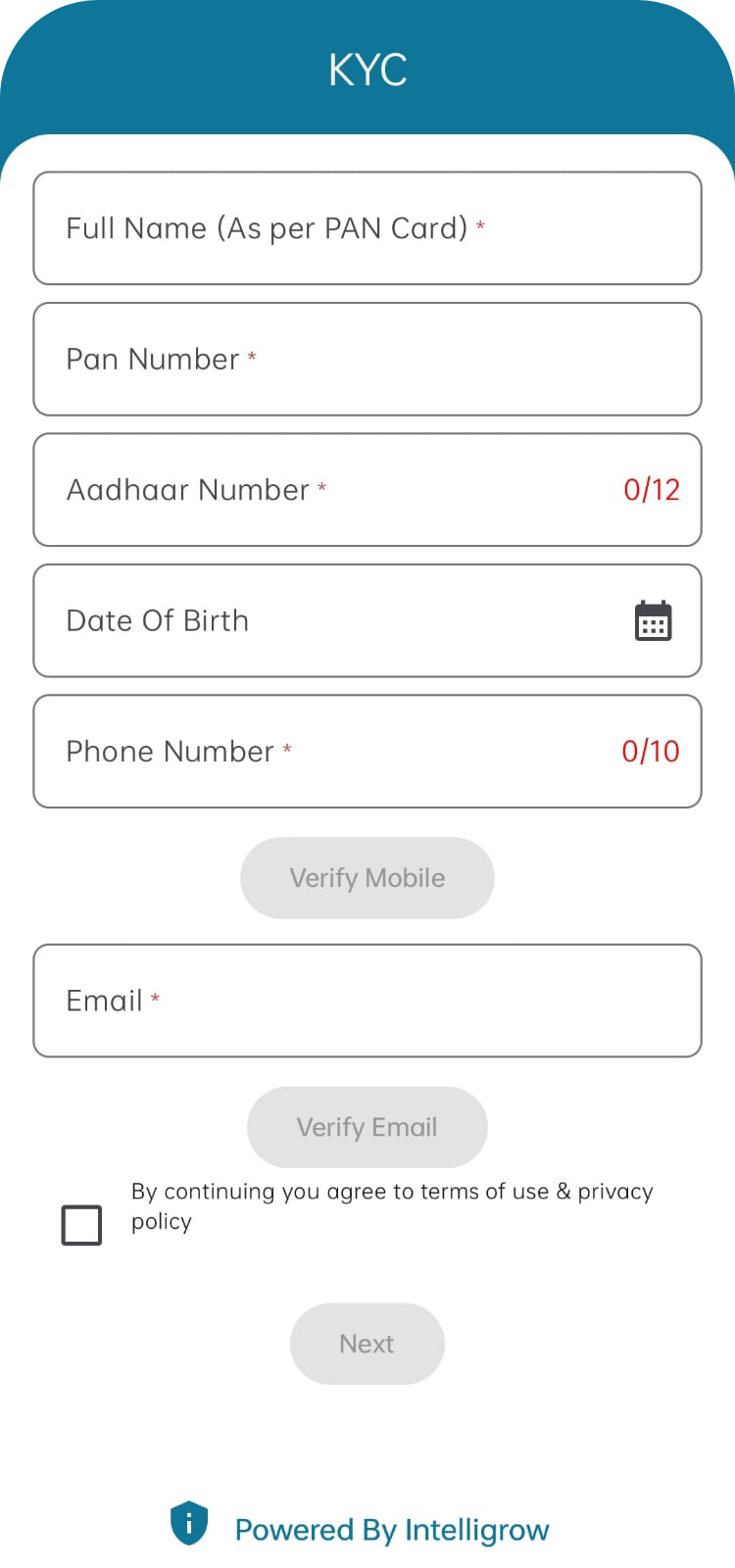

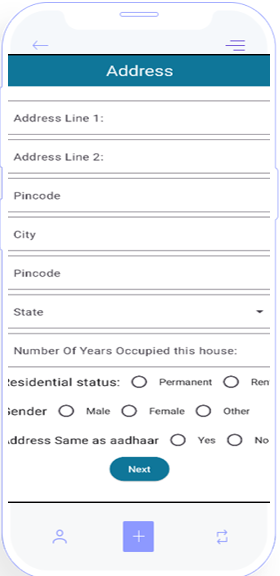

- Applicant Onboarding:The name tells you the work itself. Digital capture of borrower information, document upload, and identity verification ensure absolutely no friction in the application.

- Credit Scoring and Risk Analysis:Integration with credit bureaus and analytic engines provides real-time facilities for evaluating the creditworthiness of borrowers through algorithms based on machine learning with loan origination software.

- Automated Underwriting: Preconfigured decision rules and AI-underwritten models identify qualifying loans with minimal manual intervention.

- Compliance Management: A preconfigured regulatory framework guarantees compliance with financial rules and fraud.

- Document Management:Document workflows with legal sanctification have overwhelmingly benefited from enhanced security, versioning, and e-signatures.

- Status Tracking and Reporting:Transparent dashboards further enhance engagement between lenders and borrowers with proactive communications and performance analytics.

How Loan Origination Software is Disrupting Financial Institutions

Even now, financial institutions are pressured to not only shorten the time taken to process a loan but also reduce the chances of credit risk while complying with constantly changing regulatory frameworks. Loan origination software would make a phenomenal difference in:

- Operational Efficiency:Repeatedly automating processes will, as a result, cut down overhead and speed up processing time. Moreover, giving the personnel more time to focus on important strategic thinking is an added advantage.

- Customer Experience:More clear communication with borrowers, intuitive interfaces, and faster approvals can lead to better customer satisfaction and retention rates.

- Risk Mitigation: State-of-the-art algorithms for the analysis of debtor credit and fraud detection will lead to better risk management and even to securing assets of the institution.

- Scalability and Flexibility:Hence, a cloud-based loan origination software platform is such that it provides a scalable infrastructure in addition to flexible workflows that can meet the different demands of all types of loans and markets.

- Regulatory Compliance: Automation combined with real-time audit and reporting tools drastically reduces the risk of incurring a huge and costly punitive legal penalty.

- Data-Driven Insights: This would present every aspect of actionable intelligence in performance, market trends, and customer behaviour.

Deployment Models as Well as Customization

Loan origination software is available in different deployment models that meet the needs of diverse institutions:

- Cloud-based Software:Provided as Software as a Service (SaaS), it features speedy implementations, lower upfront costs, and updates without further intervention.

- On-Site Implementation: The product is preferred by organizations that require stringent control over data and customized configurations designed for legacy systems.

- Hybrid Models: These offer on-demand cloud agility and on-premises control for gradual digital transformation.

The customization capabilities range from configurable workflows and user roles to white-label interfaces to guarantee alignment with the brand identity as well as regulatory mandates.

Problems Addressed by Loan Origination Software

Old school loan origination methods were encumbered with piles of paperwork, prolonged periods for decision-making, complex compliance requirements, and operational inefficiencies. Loan origination software would eliminate these problems by

- Minimizing manual errors through automation and validation routines

- Data security and confidentiality become possible through environments encrypted

- Turnaround times are drastically reduced to improve competitive positioning.

- Keeping impeccable records for audit readiness

- Reduces operational costs associated with paper processes and resource redundancies

Choosing the Correct Loan Origination Software

When deciding on a loan origination software platform, here are some parameters that the financial institution needs to consider:

- Scalability: The facility that allows growth in both the loan volumes without affecting performance.

- Compliance Capabilities: e., jurisdictional regulatory requirements like GDPR, AML, and KYC.

- User Experience: An intuitive interface and multi-channel approach for both lenders and borrowers.

- Integration Ecosystem:Again, compatibility with core banking systems and external service providers.

- Security Measures:Advanced data protection methods such as multi-factor authentication, audit trails, etc.

- Vendor Support and Updates:An overall customer service record proven through regular updates and an innovation roadmap for software.

Intelligrow’s Loan Origination Software Solution

At Intelligrow, we know that loan origination software is key in a cutthroat financial service provision industry. Our solution has been carefully designed to empower lenders with the highest automatic levels, the most unique data insights, and solid compliance structures. Advanced AI and cloud technologies are utilized to create a highly flexible, real-time platform for all the loans at an extremely secure level. Loan origination software also helps us have a customer-centred approach to ensure seamless onboarding, user-friendly interfaces, and transparent loan journeys that inspire confidence and trust.

FAQs on Loan Origination Software

Q1: What category of loan does loan origination software qualify for?

It can accommodate personal, mortgage, auto, business, or payday loans, generated with different underwriting criteria and document requirements.

Q2: In what ways does loan origination software comply with laws and regulations?

It embeds all regulatory rules and compliance checks through the complete workflow, keeps audit trails, can provide real-time reporting, and runs in the same lines with compliance databases. All those are intended to put the software under the statutes such as AML, KYC, and data protection laws.

Q3: Loan Origination Software: Can it be interconnected with other banking systems?

Most types of loan origination software offer APIs that ensure seamless integration with core banking systems, credit bureaus, identity verification services, and payment processors, all of which aid in forming a connected financial ecosystem.

Q4: What are some of the benefits of using cloud-based loan origination software?

With the advantages of rapid deployment, scalability, reduced upfront costs, and automatic updates, these platforms also enable remote access, making them a perfect candidate for agility and cost-effectiveness in institutions.

Q5: Is the borrower-level experience enhanced with loan origination software?

Of course! By digitizing the application process, having dashboards for application process status updates, faster approvals, and secured document uploads, this software boosts the user experience tremendously.

Reach Us

QUICK INFO

Email: info@intelligrow.co

Address: Deshpande Startups Gokul Rd, Next to Airport, Hubballi 580030, Karnataka, India