Loan Processing Software

Advanced Loan Processing Software Designed for High-Performance Lending

In today’s virtual lending era, economic institutions require a quick, reliable, and automatic system to address loan packages, underwriting, approvals, and disbursals. Intelligrow brings you an effective loan Processing software built to streamline every step of the lending adventure. Designed for banks, NBFCs, MFIs, fintechs, and co-operatives, Intelligrow ensures accuracy, faster turnaround time, and full transparency across your lending operations.

In case you’re trying to scale smarter and decrease guide workloads, Intelligrow is the ultimate loan automation partner your commercial enterprise needs.

Book a Demo nowadays and revel in Seamless Lending Automation.

Accelerate Lending with Intelligent Loan Processing Automation

Conventional loan processing includes heavy paperwork, lengthy verifications, and excessive operational dependency. Intelligrow eliminates these challenges with a modern-day and absolutely automated loan Processing software that allows your group to approve loans faster, even as retaining complete compliance.

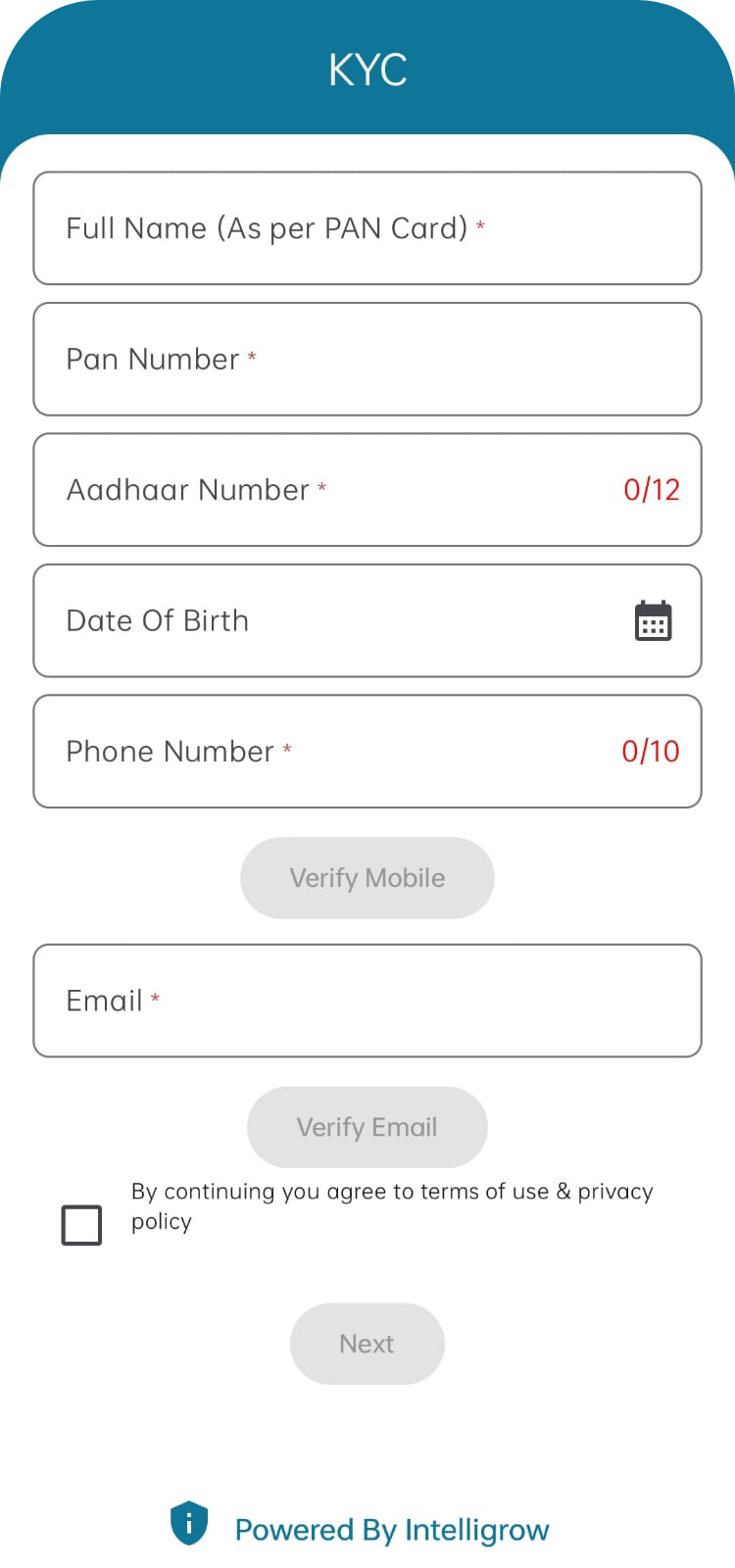

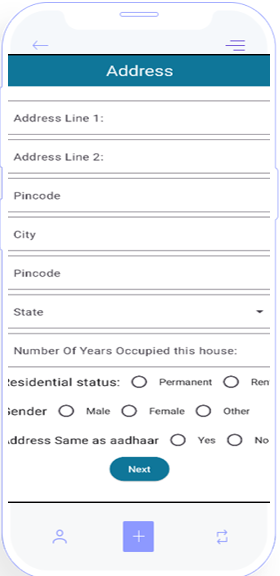

Our platform digitizes each stage, from borrower onboarding and KYC verification to hazard evaluation, underwriting, disbursal, and EMI control. With real-time insights and automated workflows, creditors can reduce value, keep away from errors, and increase customer satisfaction.

End-to-End Loan Processing Made Simple

Intelligrow is not in reality another tool. It’s far from a whole loan automation atmosphere that centralizes all lending obligations on a single dashboard. Whether you method commercial enterprise Loans, private Loans, MSME Loans, Gold Loans, customer Loans, or Microfinance, the gadget adapts for your workflow results.

Key Features of Our Loan Processing Software

- Digital onboarding & instant KYC validation

- Computerised underwriting & scoring fashions

- Configurable loan schemes & flexible interest structures

- File management & e-sign integration

- Actual-time choice-making dashboards

- Disbursal automation & reimbursement scheduling

- Compliance-ready audit trails

With this superior loan Processing software, establishments can eliminate delays, reduce operational charges, and speed up each loan cycle.

Smart Cash Recovery with Built-In Cash Collection Software

Aside from loan processing, Intelligrow also gives a powerful cash series software program that helps creditors and discipline agents music recoveries in real time. This module guarantees entire transparency and accuracy in everyday coin collections, payments, and credit score entries.

Cash collection software features include:

- impervious agent login

- Geo-tagged series entries

- Offline-to-online records sync

- Auto-updated borrower ledger

- Each day reviews, MIS & reconciliation

- Alerts for overdue collections

With Intelligrow, institutions have complete manipulate over each loan processing and coins recoveryensuring better efficiency and decreased leakage.

Why Choose Intelligrow for Your Lending Operations?

Intelligrow stands many of the most advanced lending automation structures as a result of its shrewd structure, consumer-friendly interface, and financial institution-grade protection.

What Makes Us have the fantastic desire?

- A hundred% customizable workflows

- Multi-branch & multi-consumer get right of entry to

- Cloud-based & invulnerable information encryption

- API-ready for all integrations (KYC, bills, CBS, credit Bureau)

- Cellular apps for a group of workers & borrowers

- on the spot customer support & onboarding help

Whether you are an unexpectedly growing NBFC or a longtime economic enterprise, our loan Processing software program enables you to scale without increasing operational pressure.

A Future-Ready Lending System for Growing Institutions

As virtual lending expands, the need for bendy, scalable, and automated structures becomes integral. Intelligrow ensures your institution is ready for the future with:

- Faster loan cycle

- More accuracy

- Higher client experience

- Computerized compliance

- Seamless portfolio tracking

With Intelligrow by your side, you may technique loans faster, get better bills on time, and control your give up-to-give up lending operations’ effects.

Get Started Today

Transform your lending enterprise with Intelligrow’s effective and wise loan Processing software. Reduce guide effort, accelerate approval cycles, and beautify universal productivity with a platform built for modern-day lending.

Reach Us

QUICK INFO

Email: info@intelligrow.co

Address: Deshpande Startups Gokul Rd, Next to Airport, Hubballi 580030, Karnataka, India